Calculating VAT and issuing VAT invoices. Review the full instructions for using the Malaysia Salary After Tax Calculators which details.

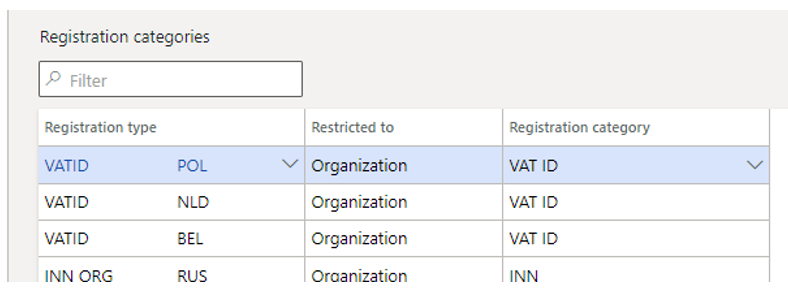

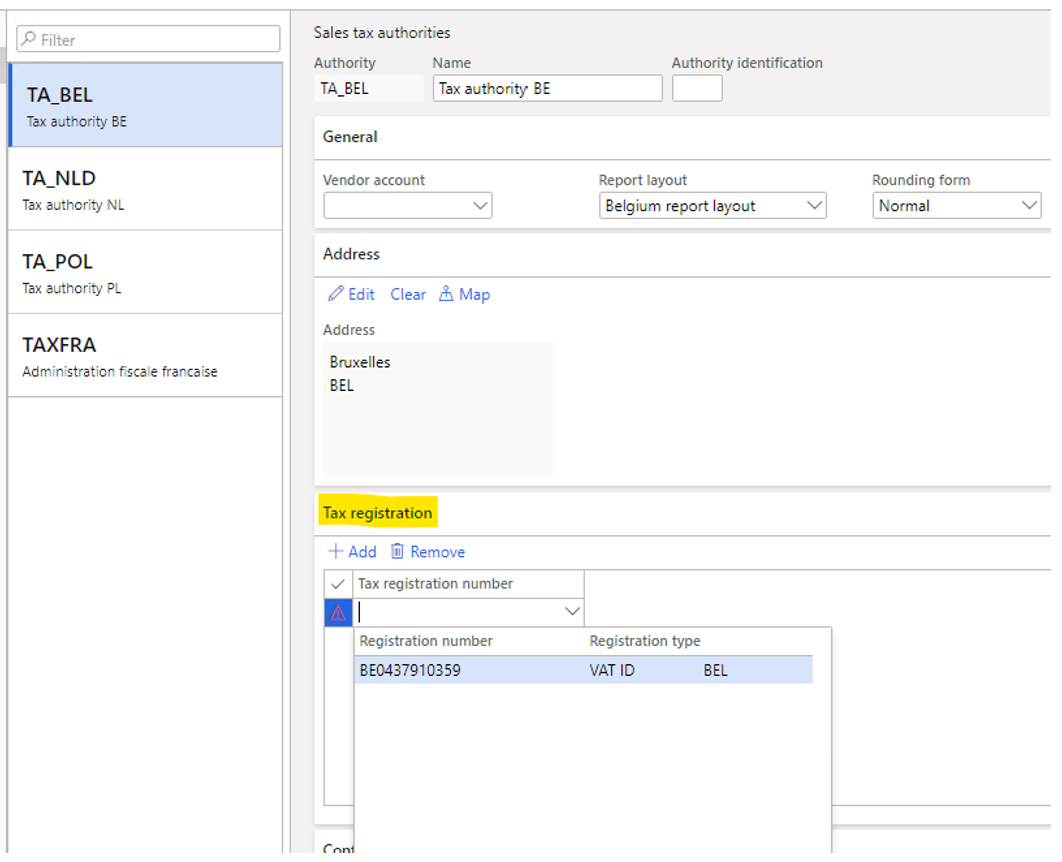

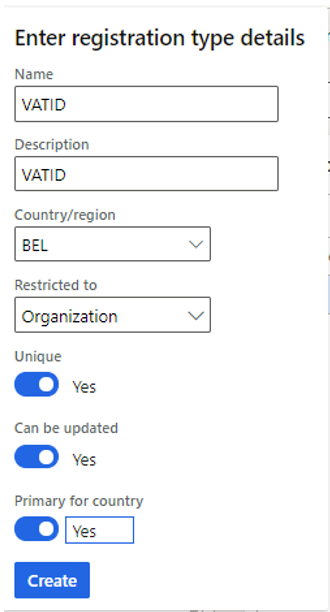

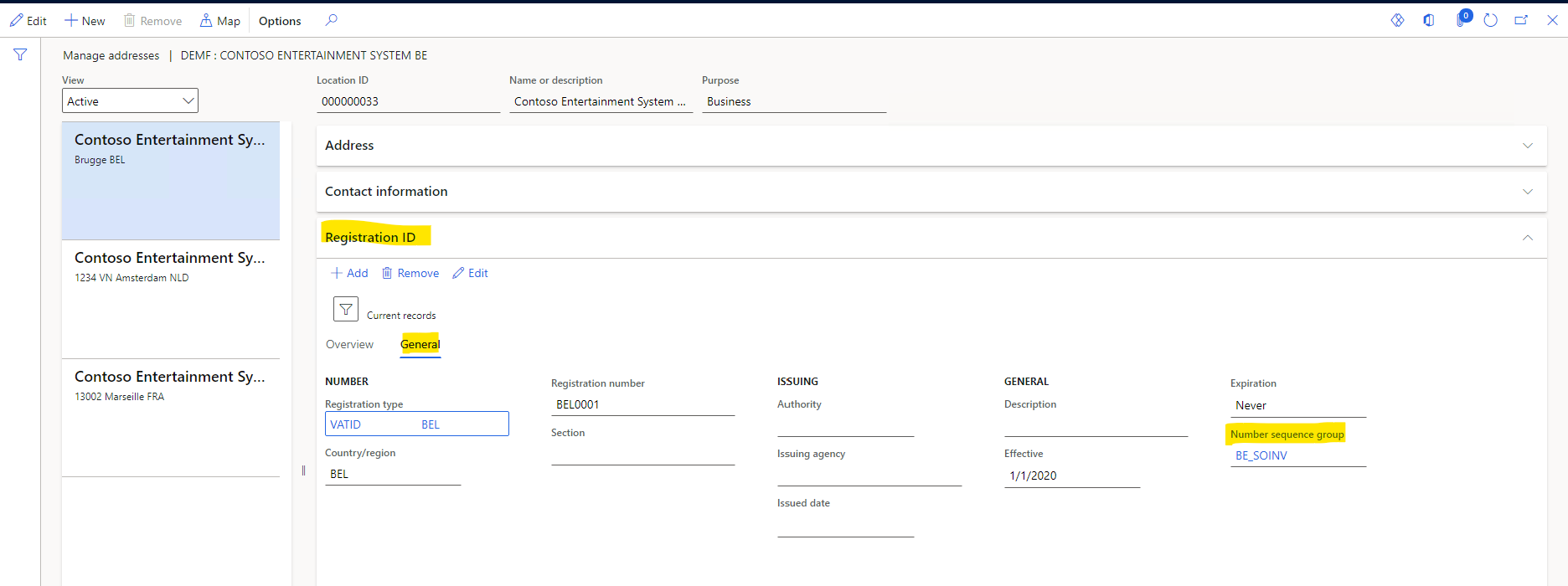

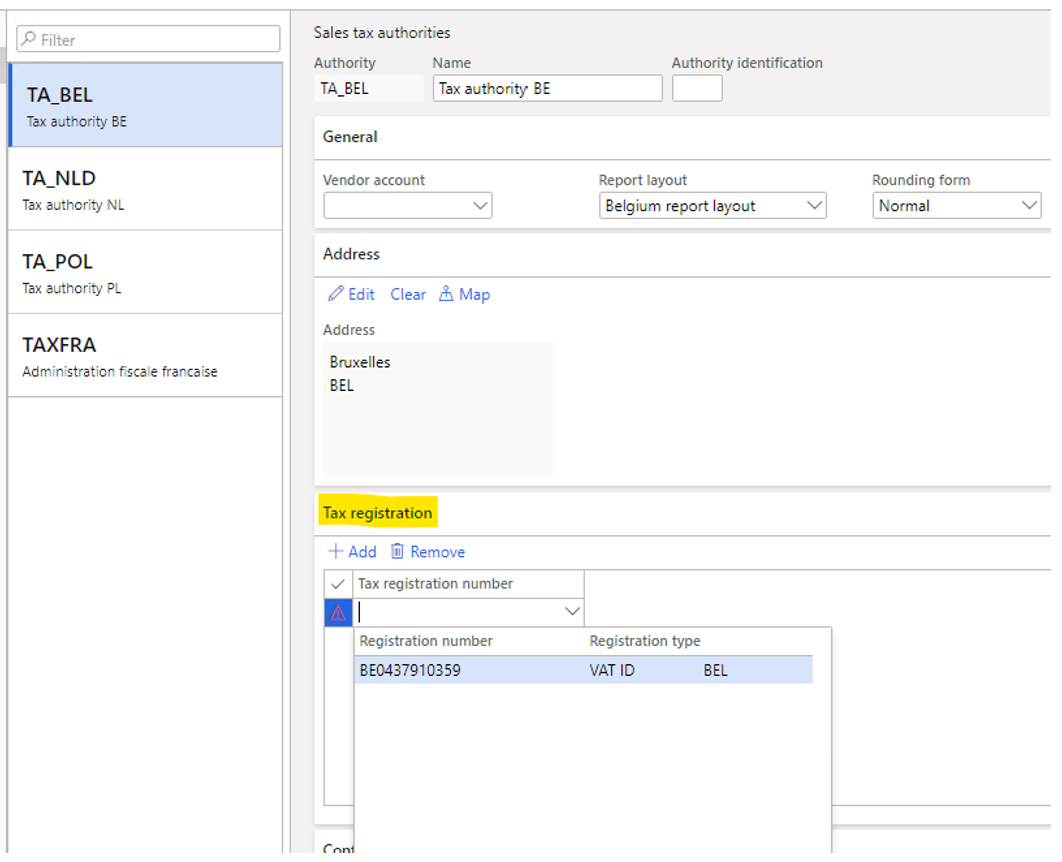

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

To find a VAT number look for 2 letters followed by a hyphen and 7-15 numbers.

. The VAT Number. The Goods and Services Tax GST was implemented on 1st April 1994 in Singapore. India which came into effect from 1 July 2017 to replace a number of other indirect taxes and the.

But enough about us lets talk about you. VAT registration numbers start with a. This will impact businesses that sell across EU country borders also known as distance sellers and.

The Inland Revenue Authority of Singapore IRAS acts as the agent of the Singapore government and administers assesses collects and enforces payment of GST. The amount of paid sick leave entitlement is based on the number of years service. They are occasionally printed on insurance forms or claims as well.

It will usually be at the top or bottom of the page. In Malaysia a 12-digit number format. Connect Xero to HMRC.

To find a VAT number look for two letters followed by a hyphen and 7-15 numbers. VAT registration numbers for Danish companies are simply DK followed by the CVR number but far from all CVR numbered entities are VAT registered companies with no need for a VAT number such as holding. The European Union EU is making important changes to its value-added tax VAT rules which come into effect on July 1 2021.

In the Accounting menu select Reports. And if so learn how to register for VAT. The MTD screen click Set up MTD for VAT in Xero.

The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. The two numbers are different. A VAT number is a government-issued identifier that only applies to companies that assess or reclaim VAT.

If this isnt an option the detective work really begins. A common mistake is to enter a tax number instead of the VAT registration number. When you join VAT IT Reclaim youll gain experience in dealing with top executive level clientele and partners.

VAT numbers are usually printed on an invoice or receiptespecially if the company includes the VAT tax in their prices. Youve probably heard about VAT before it stands for Value Added Tax and is added onto prices in the UK. PHP 3000 on each proxy of voting.

Exemption does not apply on B2B. It helps HMRC identify which employer they are dealing with. Need another tax ID type.

Tax Jurisdictions and Corresponding ID Numbers. Each employer who registers for Pay as You Earn with HMRC has a unique tax reference number. You might also use other HMRC services such as VAT or Corporation Tax receiving separate reference numbers for each of these tooKeep a list of.

The UK measures in some respects mirror those due to be rolled out in the EU from July 2021 under the EU 2021 VAT e-Commerce Package. Komando 69 they form the Pasukan Gerakan Khas Special Operations Command Police. Typical instances where a foreign trader is required to register for a local VAT number include.

The unit is headquartered at the RMP buildings in Bukit Aman Kuala LumpurTogether with the 69 Commando Malay. As part of efforts to harmonise the European VAT system and support the drive towards an EU single market for goods and services the requirements to register for a VAT number should be the same in each country. The GST Act is modelled off the UK VAT legislation and New Zealand GST legislation.

That applied previously ie. Additionally the recipient business should ensure the seller knows their VAT number or the seller will have no choice but to treat it was a B2C sale and apply VAT. Method of payment of customs duties.

The calculator is designed to be used online with mobile desktop and tablet devices. If an employee has less than two years of service they are entitled to 14 days of sick leave per year. If you are a customer in Malaysia Airbnb service fees are subject to.

Beginning Jan 1 2020 All Google Ads sales in Malaysia will be subject to a sales and services tax SST of 6. Find and open the UK VAT Return. Others such as India and Malaysia dont.

PHP 020 on every PHP 100 cost of the ticket. Screen select Making Tax Digital MTD VAT then click Continue to VAT. If youre a VAT-registered business you must add VAT to your prices.

The standard rate of VAT is 13. Asia and the Pacific. Use our Vatglobal VAT Number Checker Tool by entering any VAT Number and getting information such as the Company Name Address.

Using the correct HMRC reference number. Find out if your business needs to worry about VAT. Add your business VAT or Tax ID number here.

Central excise duty service tax VAT luxury tax etc. Import Duties of Canada to the United. The standard rate of VAT in Malaysia is.

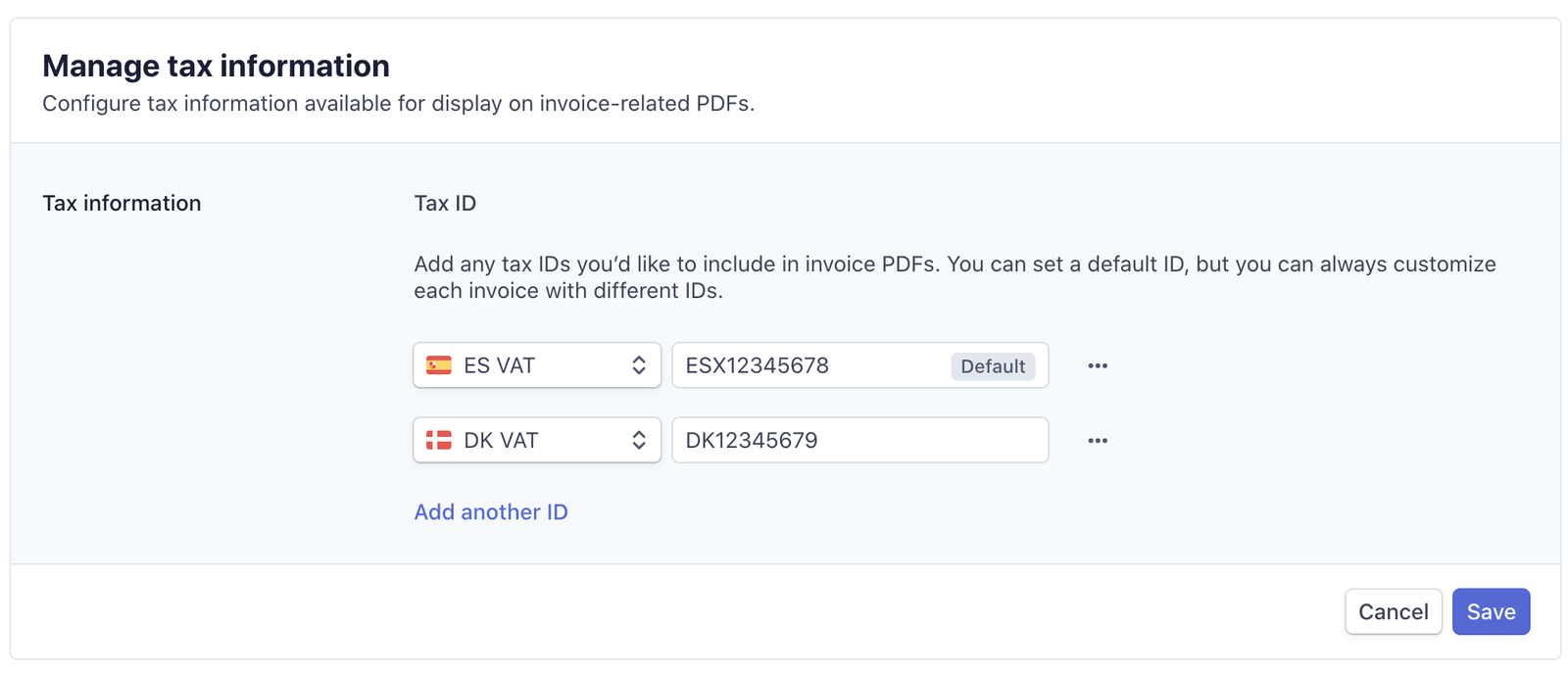

Or other authorised number games. Displaying a customers tax ID on invoice documents is a common requirement that you can satisfy by adding tax IDs to customers. Check the VAT number in financial settings is correct.

To verify a FastSpring Identification Number contact the Mutual Assistance Office in your local country. Bills of lading or receipts. Were also very proud that 50 of fortune 500 companies choose VAT IT.

The Special Actions Unit Malay. VAT applies to practically all sales of services and imports as well as to the sale barter exchange or lease of goods or properties tangible or intangible. This change affects all Google Ads accounts with a Malaysian business address.

The first step is to ensure you know the companys full official name and where its headquartered. We partner with some of the largest businesses on earth Mastercard SAP Concur and UnionPay to name a few. There are other taxes including Business Tax 3 to 20 on services.

Missing Tax ID support. VAT on imported goods is 6 in Malaysia unless special exemptions are applied. Click Continue after.

For small entrepreneurs the VAT rate applicable is 3 with limits on VAT deductions. Click on the box next to Is this a work trip when you make your booking request. VAT and Sales Tax Table of Contents.

Iii Malaysia - The new Sales Tax and Service Tax are effective from 1. YYMMDD-SS-G since 1991 known as the National Registration Identification Card Number. 1 March 2017.

Money Exchange in Malaysia. As you will have understood Malaysia is a country that is very open to international trade which encourages it by applying few constraints on its international flows of goods and investments. Look at an invoice or insurance document to find a VAT number.

اونيت تيندق خاص commonly known as and abbreviated to UTK is a tactical unit of the Royal Malaysia Police RMP. Learn how to find your VAT invoice. Following the 2012-16 VAT reforms there are only four VAT rates in China plus nil rating.

A customers tax IDs display in the header of invoice and credit note PDFs. The How would you like to file your VAT.

Seeing Number Of Gst Notices To Collect Outstanding Gst Directly From Bank Accounts Applies To Ecomm Operators Accounting Tax Services Accounting Software

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

Vat Number The Ultimate Guide Bansar China

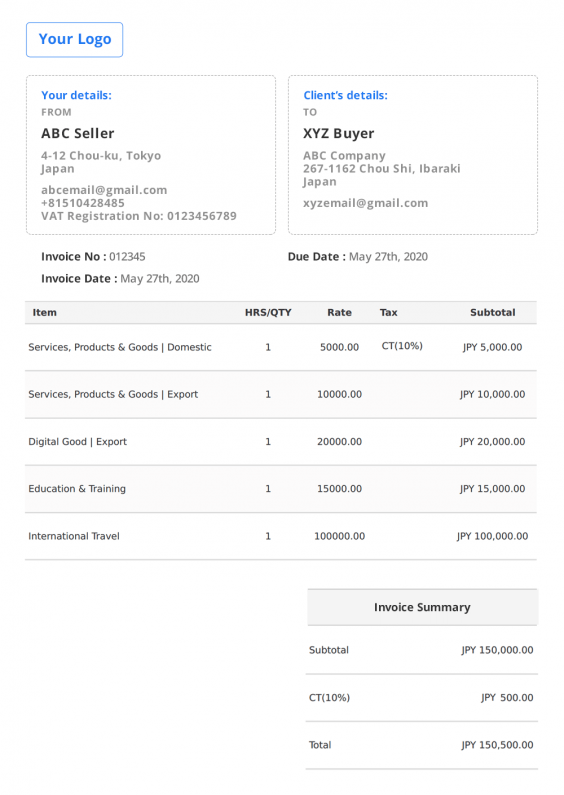

Japan Invoice Template Jct Guide Free Invoice Generator

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

Account And Customer Tax Ids Stripe Documentation

Kaospilot Masterclass Master Class Ways Of Learning Learning Spaces

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

Vat Number The Ultimate Guide Bansar China

Customer Tax Ids Stripe Documentation

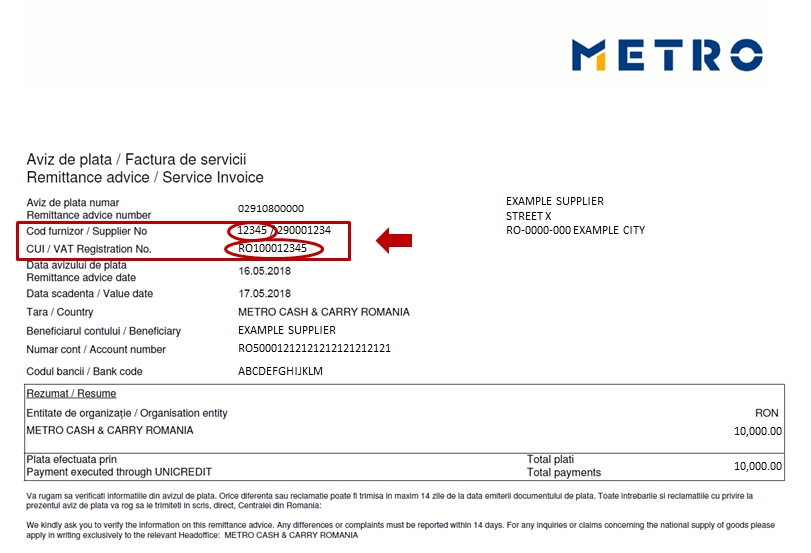

Metro Cash Carry Romania Supplier Enquiry Form Miag Eform

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

Vat Number Checker Eu Norway Switzerland Thailand Free